This article was originally published in FPPA’s PensionCheck Newsletter

Beginning in January 2023, current Members of the Statewide Defined Benefit Plan and the Statewide Hybrid Plan will participate in a new Plan, the Statewide Retirement Plan. Effective January 1, FPPA will merge the assets and liabilities of both Plans resulting in a new Plan which will be much stronger and better prepared for the future.

This action was the result of recommendations made by a Task Force formed in 2020 to study potential issues with the Statewide Hybrid Plan. After months of study, discussion, and planning, the Task Force delivered recommendations to the FPPA Board, who then directed staff to pursue legislation meant to ensure the long-term stability of the Hybrid Plan as well as the Statewide Defined Benefit Plan. FPPA’s legislation received bipartisan support at the Capitol, and was eventually signed into law in March 2022.

What does this mean? How will Members of the new Plan be affected?

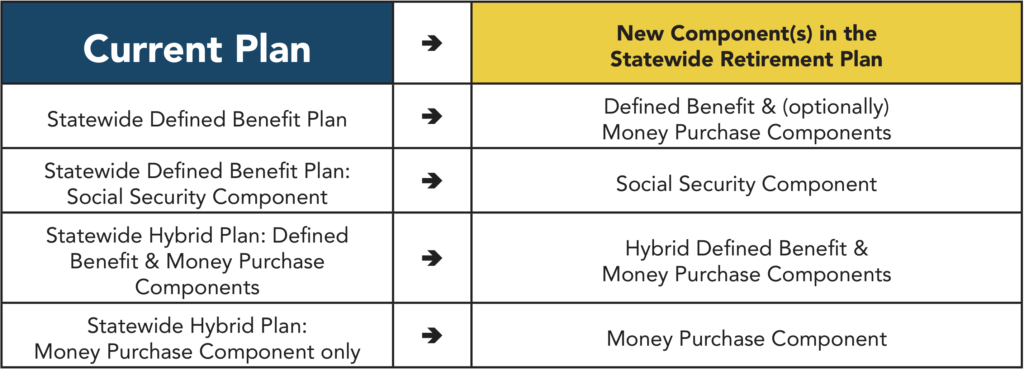

Effective January 1, 2023, Members of the Statewide Defined Benefit System will become Members of specific Statewide Retirement Plan Component(s) in the following ways:

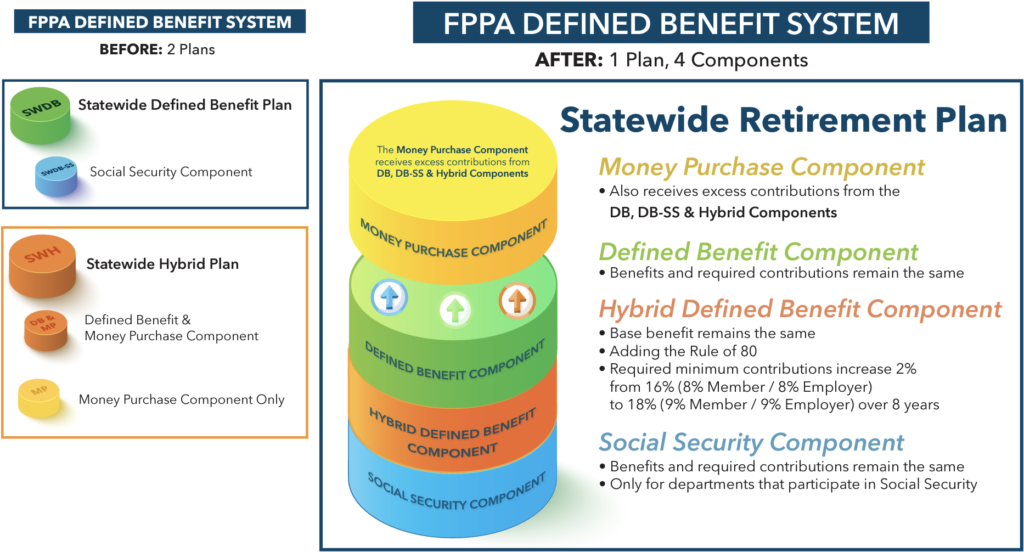

Here is an illustration of the current and future Plan structure, as described at ForwardWithFPPA.org:

Once merged, the individual Components will function mostly the same as they do now. Benefits will remain the same, and Members will still have access to features like DROP and Deferred Retirement. Plus, the Hybrid Defined Benefit Component will even see the addition of the Rule of 80, a popular feature of the Defined Benefit Component (currently the Statewide Defined Benefit Plan).

For Statewide Defined Benefit Plan Members, this change is mostly symbolic. Benefits and required contributions will remain the same. But, Members can benefit from the expansion of the Money Purchase Component, which will create an additional retirement savings vehicle for these Members.

In addition to the changes above, there are a few more changes for current Hybrid Plan Members. Since the Statewide Hybrid Plan: Defined Benefit Component is 134.6% funded as of 1/1/2022, active, terminated vested, and retired Members will receive a one-time 1.9% benefit multiplier on all accrued years of service in the Plan. The application of this one-time adjustment will bring the two Plans into level funded status at the time of the merger.

The minimum required contribution rate for Members of the Hybrid Defined Benefit Component will also increase by a total of 2%, from 16% to 18%, over an eight-year period. This will help ensure that the Component collects enough in contributions to fund the promised benefits for Component Members, plus makes meaningful contributions to the Money Purchase Component, into the future. It’s also important to note that many departments already meet the new required minimum contribution. For these departments, no contribution increase will be required. The few departments who do not meet the new required minimum have all been contacted well in advance of the effective date of these changes.

Since both current Plans will enter the merger at similar funding levels and collect contributions at a proportional rate to fund their respective benefits, the resulting Components will both pull their own weight, so to speak, and neither will be required to subsidize the other. After the merger is complete, FPPA believes that the new Statewide Retirement Plan will be stronger and better prepared for the future.

To learn more about the Statewide Retirement Plan, visit ForwardWithFPPA.org. If you have any questions, contact us.

Ryan Woodhouse is the Content and Publications Manager for the Fire & Police Pension Association of Colorado. When not managing content for FPPA, Ryan can be found fly fishing in the Colorado high country or shouting at the TV during University of Wisconsin football and basketball games.