FPPA prides itself on keeping up with our members, and not just at the big moments: enrollment, opening a 457 plan, entering DROP, filing retirement paperwork, etc. We like to know what’s going on in between these big moments so we can share in the ups, downs, wins and challenges along the way, so we’re able to help out wherever we can. With this in mind, every few years we check in with our members by conducting a satisfaction survey.

The thing is, conducting a member survey is kind of like the boombox scene from Say Anything. You know the one… it’s the scene where Lloyd—desperate to win back Diane’s affection—Stands under Diane’s open bedroom window, arms raised above his head holding an oh-so-80s boombox, blaring “In Your Eyes” by Peter Gabriel.

Lloyd is trying to communicate with Diane, but he has no idea if she’s actually in her bedroom, if she’s even awake, or if she’ll come to the window to talk to him. And, if she did come talk to him, what would she even say? Would they make up? Would she profess her undying love?

Or would she start pelting him with pens?

Now, this is by no means a perfect comparison. Our experience as FPPA staff conducting surveys is nowhere near is teenage angst-y as John Cusack in a 1989 cult classic. But it is always a little daunting to put yourself out there, asking for feedback and not knowing what type of response you’ll receive.

All of this is a really elaborate way to say that in Spring of 2019, FPPA conducted a member satisfaction survey. The short questionnaire was sent to 2000 randomly selected members; half were active, half retired. After a few weeks, we had heard back from almost 300 of you about your experience and preferences as an FPPA member. The results included, among others, this puzzling stat: more FPPA members trust internet tools and articles for financial advice than their own spouses, family, or co-workers.

But, we’re getting a bit ahead of ourselves. First let’s take a look at some basics about the survey, then unpack a few interesting insights about FPPA members.

Who We Surveyed

• 2000 surveys sent: 1000 to active members, 1000 to retirees

• 282 members completed the ~12 question survey

Of those that completed the survey:

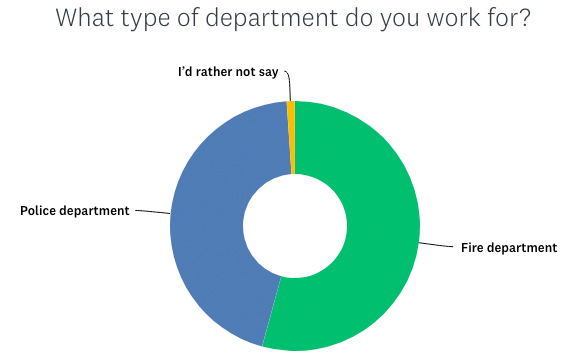

• 55% identified as working for a fire department, 44% for a police department (1% declined to answer)

• 75% were 56 years old or older, including 50% were between the ages of 56-65

• 69% indicated they were retired. 30% identified as active

So, our respondents leaned a bit more towards fire (which is consistent with our membership overall) and skewed quite a bit older (research shows that older individuals both care more about retirement finances and tend to complete more surveys than younger people).

What we learned: 4 key takeaways about FPPA members

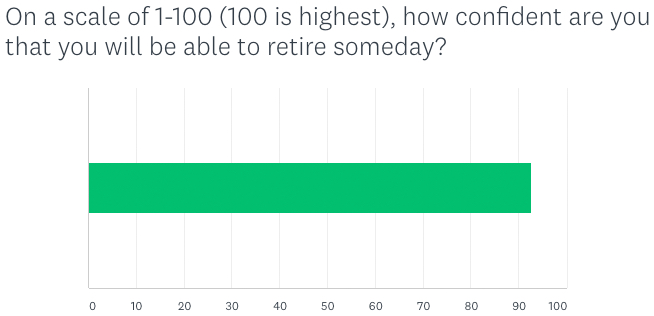

1. Active Members are confident in their ability to retire (more-so than the general public)

We asked active members how confident they are in their ability to retire someday. On a 1-100 scale, the average score came in at a 92. Interestingly, a perfect 100 was the most common response, and no one scored it lower than 50 (two responses).

These stats run contrary to recent research from Fidelity, who asked a similar question to 1,429 of their worldwide members. According to their results, 75% of respondents range from feeling only somewhat confident to not confident at all about their retirement finances. This is a huge difference from the attitudes of FPPA members.

2. Active members have developed more trust in the internet for retirement planning

Asked who they trust for retirement advice—a-choose-all-that-apply type question— the top responses were Financial Planner and FPPA. Those results were not surprising (thank you for trusting us, by the way). What was surprising was what came next for actives… the next most popular response was ‘internet tools and articles’, which outranked spouses, coworkers, family members and several other groups, all of whom ranked higher than internet tools in a similar survey in 2016.

So what happened? Yes, internet tools and content have become more robust and adaptable to different financial situations in recent years. Even FPPA’s online assortment of tools has grown in that time frame. But in our experience, there’s still a great deal of value in getting a second opinion from a live human expert when it comes to making important financial decisions.

Either way, this is certainly a trend we’ll be keeping our eye on.

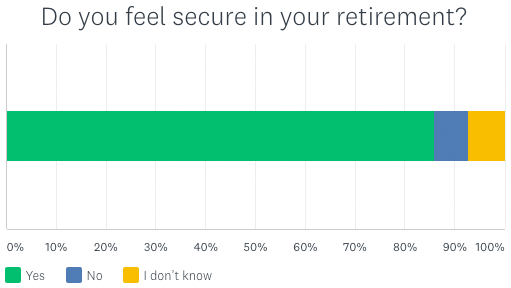

3. Retirees feel secure in their retirement

Among FPPA retirees, 86% responded that they feel secure in their retirement going forward. Similarly, on a 1-100 scale, retirees indicated that they had confidence in FPPA as their pension provider, they chimed in with a score of 85.

4. Active and retired members are quite satisfied with their membership

To a question regarding overall satisfaction with their FPPA membership, actives and retirees combined for an average score of 87 (100 point scale). Interesting note: on this question retirees scored a bit higher than actives, with a margin of 89 to 83. Not a huge difference, mind you, but something we plan to investigate further nonetheless.

Do you have any questions or specific comments regarding these results? If so please get in touch with us!

Ryan Woodhouse is the Content and Publications Manager for the Fire & Police Pension Association of Colorado. When not managing content for FPPA, Ryan can be found fly fishing in the Colorado high country or shouting at the TV during University of Wisconsin football and basketball games.