Updated: 1/11/2024

Here’s a question we often hear from Members: what is the difference between DROP and Deferred Retirement?

Some confusion is definitely understandable. After all, the “D” and “R” in DROP stand for Deferred Retirement. So already, we’re starting from a pretty tough spot.

Both DROP and Deferred Retirement are very popular among members, but for different reasons. And depending on your goals and your financial situation, one of these programs might be a good fit for you.

In this post, we’ll clear up the confusion regarding these two Plan features. To start, let’s define both terms involved.

Deferred Retirement Option Plan (DROP)

The Deferred Retirement Option Plan, as described in this video, is a way to build a cash account during your final years at your fire or police department. Technically, when you enter DROP you’ll be retiring on paper. Your monthly lifetime benefit amount will be finalized, and FPPA will begin depositing your pension checks into a self-directed account along with your Member contributions each paycheck, as you continue to work for up to five more years.

When the DROP period ends, those deposited funds will be available to you as a lump sum. You’ll have various payment options available, but essentially the account is yours to use however you want. You’ll also begin receiving your monthly benefit checks.

DROP is popular with members who want to do things like start a business, settle outstanding debts, or pay off their home. Basically any situation where the freedom of a lump sum cash account is helpful.

Deferred Retirement

Deferred Retirement allows you to delay the start of your benefit payments for any amount of time until you reach age 65. In exchange for delaying your pension, you’ll receive an increase in your benefit amount that grows as you wait. In this case, there is no cash account built up, but your monthly lifetime pension check will be larger.

This option is popular among Members who plan to continue working or have a different source of income after they separate from their department, and won’t need to collect their pension benefit right away.

Before you ask, let’s get this out of the way… no, you cannot do both DROP and Deferred Retirement

Due to FPPA rules and plan regulations, it is not possible to take advantage of both of these programs. Sometimes, this reality makes a hard decision even harder. For this reason we recommend running a few scenarios to see how these provisions might impact your specific situation.

Speaking of which…

Examples: DROP vs. Deferred Retirement

So, what might DROP and Deferred Retirement benefits actually look like in practice?

To illustrate the differences, let’s look at how these programs might benefit a fictional Member named Alex. Alex has 25 years of service and recently became eligible for a Normal Retirement with FPPA. Alex is interested in either entering DROP for five years to build up a lump sum cash account, or using Deferred Retirement for five years to increase his lifetime monthly benefit.

Alex is 55, has 25 years of service in the Statewide Retirement Plan: Defined Benefit Component, and makes $100,000 per year. For the purposes of this calculation, we’ll also say Alex’s Highest Average salary is $100,000.

What’s Alex’s Normal Retirement Benefit?

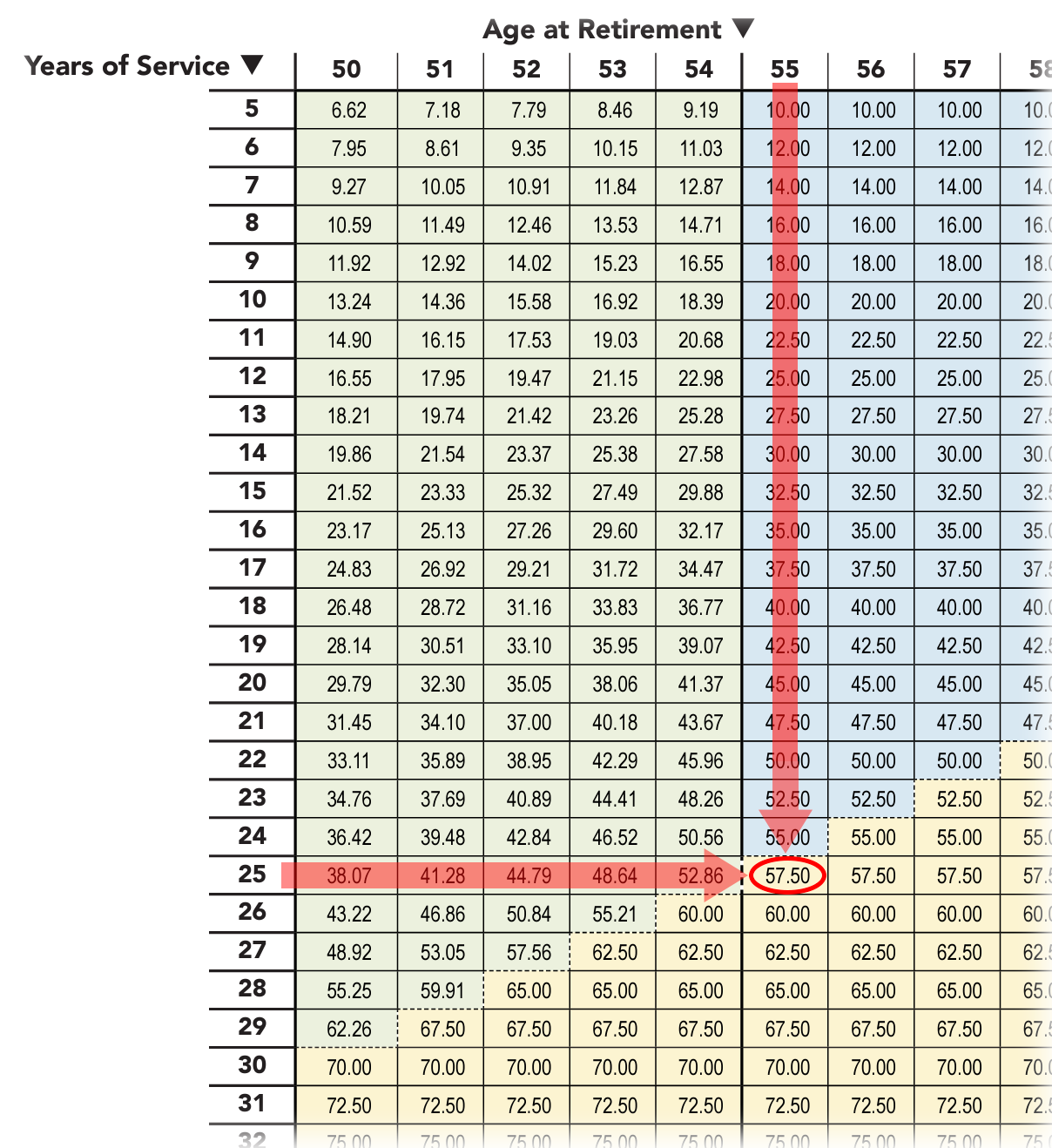

Both DROP and Deferred Retirement benefit calculations are based upon a Member’s Normal Retirement benefit, which is the amount they would receive each month if they began receiving their pension immediately when they retire. To calculate this monthly benefit, we’ll reference the chart on page two of the Statewide Retirement Plan brochure:

Shown above, Alex is eligible for a benefit of 57.5% of his highest average base salary, or $57,500 per year. Broken down monthly, that earns Alex a monthly lifetime pension check of $4,792, before applicable taxes.

In other words, if Alex elected to receive a Normal Retirement benefit—without additional funds from DROP or Deferred Retirement—he would receive $4,792 in lifetime pension benefits each month (before taxes) once he retired.

What if Alex entered DROP?

If Alex chose to enter DROP for the maximum of five years, as explained above, his monthly benefit and member contributions would be collected in a self-directed account. This includes his $4,792 monthly pension check and Alex’s 12% member payroll contributions. Over the five years Alex will continue working, his DROP account could build up to something like this:

Five Year DROP Example

Total benefit payments

(monthly defined benefit x 12 months per year x 5 years)

+

Total member contributions

(12% monthly member contribution x 12 months per year x 5 years)

+

Assumed investment return: 3%

=

Final DROP Account Balance: $393,515*

In our example, Alex’s account would contain over $393,000 once he finished five years of DROP. This depends on a few factors, like investment returns and actual time spent in DROP. Alex would also start receiving his monthly benefit of $4,792 once he exits DROP.

What if Alex Went With Deferred Retirement?

Rather than building a lump sum, Deferred Retirement allows FPPA Members to receive a larger monthly benefit check each month by delaying the start of their payments after separating from their department. Members are eligible to begin this deferral at age 55.

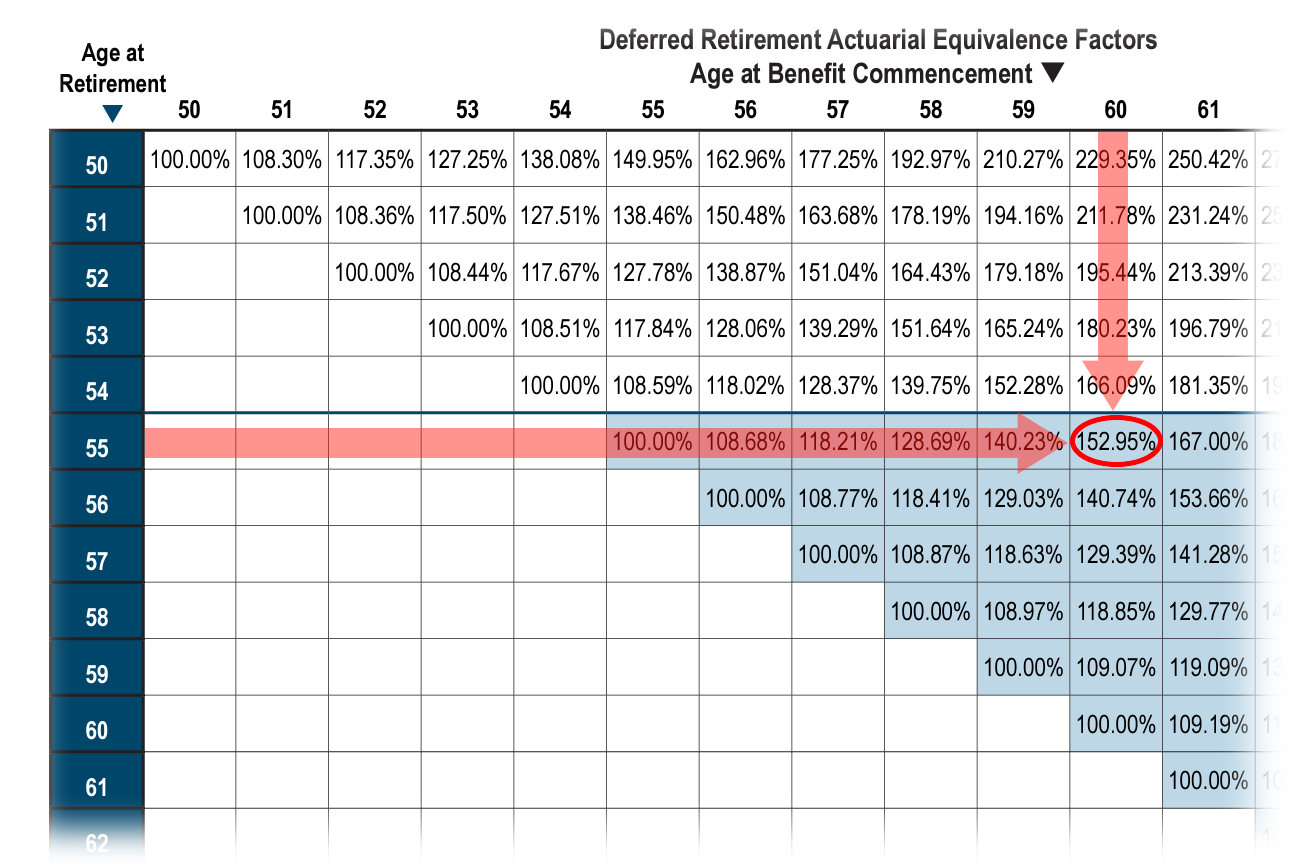

Let’s say Alex plans to stop working for his department at age 55, but continue working for a few years in a different industry. He doesn’t need his pension check right away so he decides to go into Deferred Retirement for five years. To calculate his eventual benefit, we’d start with his monthly benefit as of his Normal Retirement date of $4,792. We’d then compare it to the chart on page five of the Statewide Retirement Plan Brochure:

Next, we’d calculate Alex’s deferred monthly benefit by multiplying his original Normal Retirement benefit by the factor shown on the chart above:

Five Year Deferred Retirement Example

Normal Retirement Benefit: $4,792

x

Five Year Deferral Factor: 152.95%

=

Adjusted monthly lifetime benefit: $7,329.36*

By deferring his benefit payments for five years, Alex’s defined benefit would increase to over $7,000 each month. For comparison, going into DROP would result in a projected lump sum of over $393,000. Deferring his retirement would add over $2,500 every month to Alex’s lifetime benefit, but wouldn’t generate a lump sum cash account.

Another Option: Normal Retirement

Sometimes, the best option between DROP and Deferred Retirement is neither. Some Members reach Normal Retirement age and they’re simply ready to begin drawing their monthly lifetime benefit and enjoy their next chapter. And there’s nothing wrong with that! There is no requirement to participate in DROP, Deferred Retirement, or any other plan feature.

Bottom Line: Which One is Better?

In truth, the best option is the one that works for you. It’s a cliché answer, but it’s absolutely true. Depending on your unique situation, DROP, Deferred Retirement or neither might be the right decision.

Our best advice: work with your financial advisor and an FPPA benefit administrator to determine which option best fits your financial goals.

Do you have questions about DROP or Deferred Retirement? Drop us a line! (Pun intended)

*This simplified example is an estimate for illustrative purposes only. Estimates and results vary based on individual circumstances

Ryan Woodhouse is the Content and Publications Manager for the Fire & Police Pension Association of Colorado. When not managing content for FPPA, Ryan can be found fly fishing in the Colorado high country or shouting at the TV during University of Wisconsin football and basketball games.